Meet The New Agency SEO Template From The Avada Team

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

See Our Top Notch Services

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

Our Work

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

Our Plans

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

Standard

- 5 Projects

- 5 GB Storage

- Unlimited Users

Premium

- 10 Projects

- 15 GB Storage

- Unlimited Users

Professional

- 15 Projects

- 30 GB Storage

- Unlimited Users

Extreme

- Unlimited Projects

- Unlimited Storage

- Unlimited Users

Our News

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium.

Pulte plans 'full scale review” of credit bureaus

Bill Pulte, the head of an oversight agency for mortgage giants Fannie Mae and Freddie Mac, is planning "a full scale review" of the credit bureaus.The director of the entity formerly known as the Federal Housing Finance Agency posted the statement on X Friday afternoon, and subsequently indicated on early Monday he also wants to change the wording around another factor in the secondary market that can affect mortgage rates lenders offer consumers."We are looking into changing the name of 'LLPA' to just 'pricing," said Pulte, who now calls FHFA U.S. Federal Housing, in a separate social media post. The acronym refers to loan-level price adjustments Fannie and Freddie make for mortgage characteristics that could be negative, such as a low credit score.Pulte also reaffirmed past statements indicating he's "not happy with" with industry's main score provider, has heard the industry's concern about higher credit cost and plans to take near-term action, in another recent post.Score provider FICO has downplayed its role in higher credit costs, saying the credit bureaus charge a larger amount. FICO and Vantagescore plans have been on track to implement legislatively-mandated advanced score models for Fannie and Freddie, which Pulte said could proceed if it proved efficient.How multiple entities and reports impact mortgage credit costsEfficiency has been a central concern in the mortgage industry's push to implement advanced credit scores and reporting, which could improve the use of alternative indicators to assess borrowers' ability to repay and expand access to safe financing.There has been debate over whether the mortgage industry's traditional use of a tri-merge credit report, combining data from Equifax, Experian, and TransUnion, is truly necessary. A Standard & Poor's study found there wasn't a significant difference in using two credit reports rather than three in line with an FHFA proposed in a Biden era, but separate Transunion research indicated it could cost some borrowers thousands of dollars over the life of their loan.Some legislators have backed the retention of the trimerge for the time being, saying the research into what ending it would mean to date hasn't been sufficient.Mortgage Bankers Association President and CEO Bob Broeksmit said in a blog post that his organization is looking into the viability of using a single score. He noted that other industries do this.One counterargument to using only one score is that mortgages are far larger than other consumer loans and require more careful vetting. "The tri-merge credit report reflects the most accurate picture of a consumer's creditworthiness and is an essential driver of safety and soundness in the mortgage ecosystem," Transunion said in a previous statement.How credit and closing costs in home lending compareFICO scores have been rising in recent years, markedly increasing from 60 cents to $2.75 in 2023, according to a past company blog by CEO Will Lansing. After it eliminated tiered pricing in 2024, the cost increased to $3.50, or around 15% of a $70 tri-merge report. This year it increased to $4.95.Anecdotal evidence suggests hard-pull tri-merged reports used in origination (as opposed to a soft pull for qualification purposes) have cost from $50 to $110, according to the CFPB's call for closing-cost feedback last year"Our profit margin for this product has remained materially unchanged for decades. The only substantial increase in our profit margin occurred in 2016," Transunion said in a response to the closing cost inquiry. Transunion said margin adjustments are made to account for inflation.FICO does have some influence over the credit reporting agencies' pricing, according to the Community Home Lenders of America."While FICO does not set specific prices to the end-use (lender and their customers), their market power allows them to unilaterally raise boundaried wholesale prices to the national CRAs," the trade group noted in a 2024 white paper, adding that the increase gets passed on to resellers.It's also important to note that credit reporting, scoring, and reselling costs are not the biggest drivers of ancillary mortgage expenses, according to the Consumer Data Industry Association and the CFPB."The largest disclosed closing costs are origination fees paid to the lender (including discount points). Title fees (including title insurance, title search, and settlement fees) are the next largest category of closing costs (and loan costs)," the CFPB noted in its request for feedback last year.

Buyers need up to $250K more in income in some cities

Even as some factors causing current affordability challenges show signs of easing, a new study points to how high a barrier many aspiring buyers still have to get over to achieve homeownership. To afford a typical U.S. home currently priced at $367,969, households earning today's median salary would need an additional $17,670 in annual income to meet monthly payments, even with 20% down. With only a 10% down payment, those same buyers would require a raise of $36,287, according to a new report from Zillow. The median priced home now demands a near six-figure salary, the report said. In 2023, the median U.S. household income was $82,168, according to U.S. Bureau of Labor Statistics data.Today's housing affordability data contrasts sharply with the U.S. market of five years ago, when a median salary still offered consumers an opportunity to purchase the median-priced U.S. home. "Affordability remains a steep hill to climb, especially for first-time buyers," said Kara Ng, senior economist at Zillow, in a press release. Elevated cost pressures remain even as the housing market shows consistent signs of thawing this year. Housing indicators show regular softening of home-price growth with small dips occurring in some regions, as reports from several research groups suggest the market is shifting in favor of buyers. Properties sitting unsold for longer, as well as a higher rate of canceled agreements, are both driving a recent bump in supply that applied downward affordability pressure. "While the financial bar has gotten higher, we're also in the middle of the most buyer-friendly spring since before the pandemic for those who can make the finances work," Ng said."To make homeownership more broadly accessible, though, we need lasting solutions, starting with policies that allow more homes to be built in the right places," she also added. Where are the most affordable markets?Although affordability challenges are widespread, several urban markets still have an ample supply of homes meeting median incomes, Zillow reported. Located primarily in the Midwest and Northeast, the number of markets with affordable median prices decreased to just 11 from 39 five years ago, though. Cleveland came in as the most affordable market where the median income earner could buy a typical $244,000 home and still have over $11,500 left at the end of the year. Pittsburgh, St. Louis and Cincinnati followed as the next three markets where housing costs were low enough to still allow home buyers to keep some earnings, with leftover income of $11,244, $4,897 and $4,396 available.On the other end of the scale, California markets had the lowest levels of affordability with four cities requiring six-figure raises for median earners to achieve homeownership. Buyers in San Jose would need $250,000 more in annual income to afford a typical home. In San Francisco, median income would need to increase by over $165,000. Los Angeles and San Diego followed, with approximately $149,000 and $129,000 required each year on median salaries. How high home prices have changed the rental marketThe difficulty in buying an affordable home in desirable markets also led to shifts in the rental housing market. Single-family rental homes now go for 41% more than they did five years ago, Zillow noted. The surge outpaced rent increases in multifamily properties, which rose by 30% over the same period.Over half the rental population was over the age of 40 in 2024, with the median at 42. One-third of rental households include children under the age of 18, Zillow reported last year.

Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates?

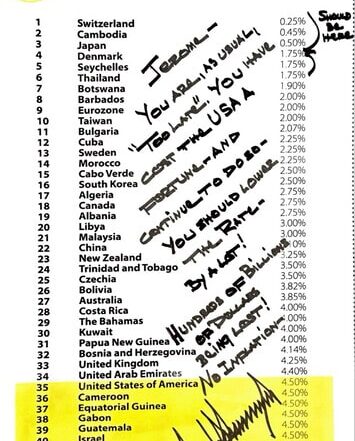

President Trump’s latest salvo against Fed Chair Jerome Powell called for 1% interest rates.And he added that he’d “love him to resign if he wanted to, he’s done a lousy job.”Thing is, if the Fed were to cut its own fed funds rate to 1%, how would that actually affect mortgage rates?There’s not a clear correlation between the short-term FFR and the long-term 30-year fixed.So there’s no guarantee Powell’s replacement, if he/she were to lower rates aggressively, would lead to lower mortgage rates too.Trump Wants 1% Interest Rates and a Powell ResignationThe President told reporters that “I think we should be paying 1% right now, and we’re paying more because we have a guy who suffers from, I think, Trump Derangement Syndrome.”He also posted this image on his Truth Social account saying rates should be in the 1% or less range.This isn’t the first time Trump has called on Powell to lower rates, nor will it be the last, but I found it interesting he explicitly asked for 1% rates this time around.To put that in perspective, the FFR is currently at a range of 4.25% to 4.50%.It was effectively set at zero from 2009 to 2015, and again during the pandemic, before rising above 5% to combat out-of-control inflation.Last year, the Fed cut its key policy rate 100 basis points (bps) via four rate cuts, but has since taken their foot off the pedal.Trump and FHFA President Pulte have both been pressing Powell to keep cutting, with their critique of his job as Fed boss growing louder and louder.Thing is, the Fed doesn’t control mortgage rates. You could lower the FFR without seeing a meaningful change in mortgage rates.Any cuts need to be a warranted in order for bond yields to come down. And it is the 10-year bond yield that correlates with long-term mortgage rates.So while the Fed could start aggressively cutting again with a Powell replacement, the bond market might not respond as Trump and Pulte expect.Really, the only way to forcibly bring back record low mortgage rates, or at least markedly lower mortgage rates, would be via direct Fed intervention.This means another round of QE, where the Fed buys mortgage-backed securities (MBS) to increase prices and bring down associated yields (interest rates).But the chance of that remains slim, at least at this juncture. Though you can’t rule anything out if the housing market continues to stall as it has.Interest Rates at 1% Would Lower HELOC Rates SignificantlyWhen it comes down to it, the only guarantee you get from a Fed rate cut is a lower prime rate, because they move in lockstep.The prime rate is historically priced around 300 bps (3%) above the fed funds rate. This spread is constant, so if the FFR goes down by 25 bps, the prime rate goes down by 25 bps too.It’s currently at 7.50%, while the FFR is 4.25% to 4.50%, so if the Fed somehow agreed to cut their rate to 1%, you’d have prime at 4%.That’d be great news for homeowners with HELOCs, which are priced based on the prime rate.Whenever prime goes down, so too do HELOC rates. So that would result in big savings for those with HELOCs.They’d see their interest rates drop about 350 basis points (3.5%), which would obviously result in a massive decrease in monthly payment in the process.But the 30-year fixed could be a different story entirely. If the bond market doesn’t like the Fed rate cuts, perhaps because they feel forced, they might not react as expected.Same with MBS investors. So any great plan to lower mortgage rates and give the housing market a boost might not come to fruition.However, if the economy does continue to show signs of slowing, with falling inflation and rising unemployment, bond yields should theoretically come down as well.In that case, you’d get a lower 30-year fixed mortgage as well, but that wouldn’t really be due to the Fed.It’d be driven by the economic data, which ironically is what drives Fed policy decisions in the first place. Before creating this site, I worked as an account executive for a wholesale mortgage lender in Los Angeles. My hands-on experience in the early 2000s inspired me to begin writing about mortgages 19 years ago to help prospective (and existing) home buyers better navigate the home loan process. Follow me on X for hot takes.Latest posts by Colin Robertson (see all)

What Our Clients Say

Ability proceeds from a fusion of skills, knowledge, understanding and imagination, consolidated by experience.

Beauty is when you can appreciate yourself. When you love yourself, that’s when you’re most beautiful.